2024年外商直接投资信心指数显乐观

录入编辑:襄策合规 | 发布时间:2024-05-20科尔尼(Kearney)近日发布的2024年外商直接投资信心指数(FDICI)报告,报告经襄策合规整理后,部分内容如下:

Recent years have been characterized by heightened geopolitical tensions—intensifying further because of the onset of conflict in the Middle East in Q4 2023, the reverberations of climate crises, and high levels of technological disruption. Global growth has been anemic, reaching just 3.1 percent in 2022 and falling to 2.7 percent in 2023.1 This year is slated for an additional decline, with global growth forecast at 2.4 percent. Nevertheless, there are some positive economic indicators. Inflation is coming down throughout the world, the US economy is faring much better than expected, and Asia continues to be a piston of global growth. While our survey was in the field in January 2024, it appears investors were guided in their responses by this positive economic news and were less focused on the negative.

近年来,地缘政治紧张局势加剧,尤其是在2023年第四季度中东冲突爆发、气候危机余波未平以及技术颠覆程度高企的背景下,这种紧张局势进一步升级。全球增长乏力,2022年仅增长3.1%,2023年则降至2.7%。1 今年预计还将继续下滑,全球增长预测为2.4%。然而,也有一些积极的经济指标。全球通胀正在下降,美国经济远超预期表现良好,亚洲仍是全球增长的引擎。尽管我们的调查是在2024年1月进行的,但似乎投资者在回应调查时受到了这些积极经济消息的引导,而对负面因素关注较少。

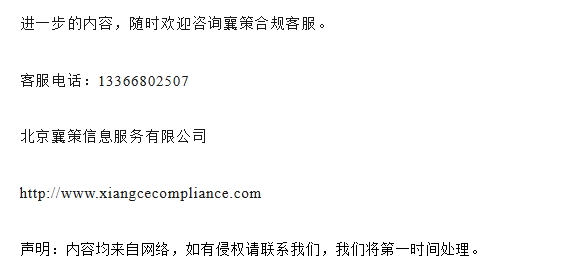

Indeed, survey respondents showed (somewhat surprising) signs of optimism. A striking 88 percent said they were planning to increase their FDI in the next three years—6 percent more than last year. Furthermore, 89 percent said they regarded FDI as more important to their corporate profitability and competitiveness in the next three years—up from 86 percent last year. And the level of net optimism on the global economy rose markedly by an impressive seven points (see figure 1). While the optimism level rose by only one point to 64 percent, net pessimism decreased from 35 to 29 percent compared with last year. These findings all suggest that while investors are not blown away by the state of the global economy, they nevertheless have an increasingly positive outlook.

调查受访者表现出了(些许令人惊讶的)乐观迹象。高达88%的受访者表示计划在未来三年增加外国直接投资(FDI)——比去年高出6个百分点。此外,89%的受访者表示,在未来三年中,他们认为FDI对公司盈利能力和竞争力更加重要——比去年增加了3个百分点。而全球经济的净乐观情绪显著上升了令人印象深刻的7个百分点(见图1)。虽然乐观情绪仅上升了一个百分点至64%,但与去年相比,净悲观情绪从35%降至29%。这些发现均表明,尽管投资者对全球经济的现状并不感到震惊,但他们的前景展望却越来越积极。

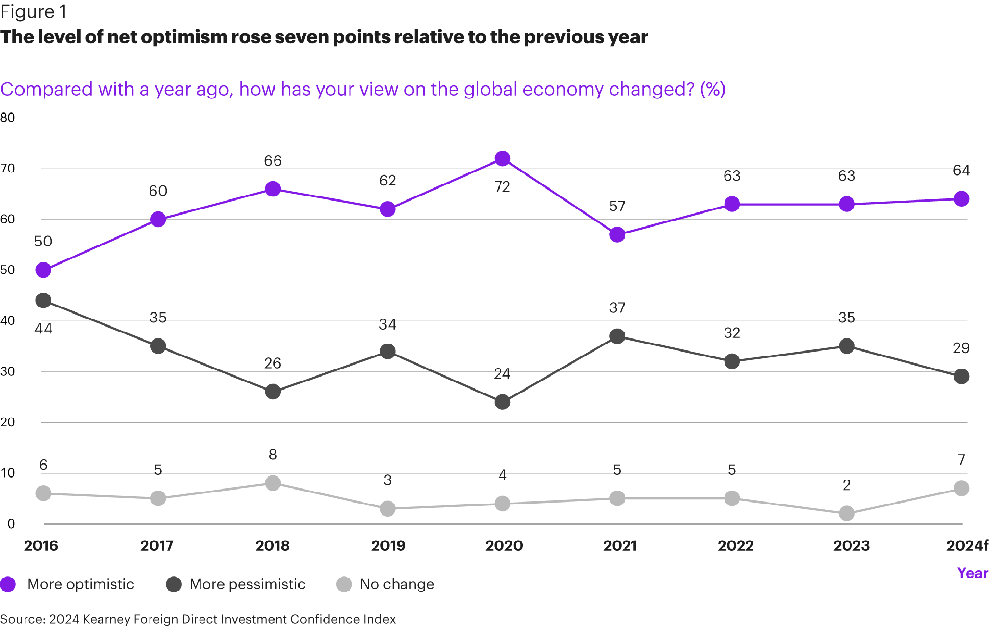

This year’s survey once again demonstrated investor preference for trusted and developed markets, which accounted for 17 of the 25 economies on the Index. This is a decrease from the 19 developed markets that dominated the Index last year, however, suggesting that investor sentiment about emerging markets is on the upswing. Of the top 10 markets this year, nine were in the top 10 last year, and two—China (including Hong Kong) and the United Arab Emirates—are emerging markets (see figure 2). Emerging-market performance improved markedly overall this year, with China jumping four spots to 3rd position and the United Arab Emirates and Saudi Arabia making a striking jump from 18th to 8th and 24th to 14th, respectively. Further, India claims a rank of 18, while Brazil (19th), Mexico (21st), Poland (23rd), and Argentina (24th) rejoin the main Index after varying periods of hiatus.

今年的调查再次显示出投资者对可信赖的发达市场的偏好,指数中的25个经济体中有17个是发达市场。然而,这比去年主导指数的19个发达市场有所下降,这表明投资者对新兴市场的情绪正在上升。在今年的前10大市场中,有9个去年也位列前10,其中两个——中国(包括香港)和阿联酋——是新兴市场(见图2)。今年新兴市场的表现整体显著改善,中国跃升四个名次至第三位,而阿联酋和沙特阿拉伯分别从第18位跃升至第8位和第24位升至第14位。此外,印度排名第18位,而巴西(第19位)、墨西哥(第21位)、波兰(第23位)和阿根廷(第24位)在经历了一段时间的缺席后重新加入主要指数。

The United States takes the top ranking for the 12th consecutive year. The strength of the US economy—the fastest growing in the G7—and rebounding consumer sentiment likely supported this score. Canada also makes a strong showing, maintaining its second-place rank and forming part of the top five markets for the 12th consecutive year. China jumps from 7th position to 3rd, which could be explained in part by its loosening of capital controls for foreign investors in Shanghai and Beijing in September 2023. And Japan drops from 3rd to 7th, likely reflecting the continuing economic woes of the market, which entered a recession in Q4 2023. Overall, this year’s survey revealed investors’ preference for developed markets, which accounted for 17 out of 25 of the markets on the Index. However, emerging markets continue to build their presence on the list, with the United Arab Emirates and Saudi Arabia in particular experiencing meteoric rises from 18th to 8th and 24th to 14th, respectively.

美国连续第12年位居榜首。美国经济的强劲——作为七国集团中增长最快的经济体——以及消费者信心的反弹,可能支持了这一得分。加拿大也表现出强劲实力,连续第12年保持第二名的排名,并连续第12年位列前五市场之一。中国从第7位跃升至第3位,部分原因可能是2023年9月,中国放松了上海和北京对外国投资者的资本管制。而日本从第3位降至第7位,这可能是由于日本市场持续的经济困境,该市场在2023年第四季度陷入了衰退。总体来说,今年的调查显示,投资者偏好发达市场,指数中的25个市场中,有17个是发达市场。然而,新兴市场在榜单上的地位继续增强,特别是阿联酋和沙特阿拉伯,分别从第18位跃升至第8位和第24位升至第14位。

The second annual ranking for emerging markets welcomes newcomers to the top 25. China, the United Arab Emirates, Saudi Arabia, India, Brazil, Mexico, Poland, and Argentina make up the top eight positions, and they are the only emerging markets included in the world rankings. Regionally, the Americas has the most markets on the list with nine, followed by Asia Pacific at seven, the Middle East and Africa at five, and Europe at four. Southeast Asia continues to show its strength, with Thailand, Malaysia, Indonesia, and the Philippines all among the top 15. Seven of the 25 markets on the Index— Poland, Chile, Romania, Peru, Hungary, Uruguay, and Oman—joined the list for the first time.

新兴市场的第二次年度排名迎来了前25名的新成员。中国、阿联酋、沙特阿拉伯、印度、巴西、墨西哥、波兰和阿根廷占据了前八名位置,也是世界排名中唯一的新兴市场。从地区来看,美洲在榜单上的市场数量最多,有九个,其次是亚太地区的七个,中东和非洲的五个,以及欧洲的四个。东南亚继续显示出其强劲实力,泰国、马来西亚、印度尼西亚和菲律宾均位列前15名。指数中的25个市场中,有七个市场——波兰、智利、罗马尼亚、秘鲁、匈牙利、乌拉圭和阿曼——首次加入榜单。